Filing Fake Tax Returns and California Tax Fraud (Revenue and Tax Code Section 19706) - Wallin & Klarich

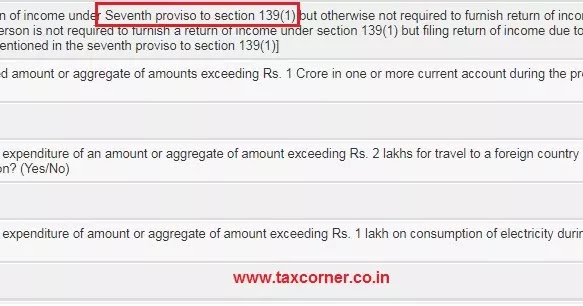

Taxation Updates 📊 on Twitter: "Draft common Income-tax Return-request for inputs from stakeholders and the general public From @IncomeTaxIndia 1:The proposed draft ITR takes a relook at the return filing system in

Bryan Cave Leighton Paisner - Are Those Taxes Owing On Your Late-Filed Tax Return Dischargeable? Maybe, But You Better Be In The Right Circuit

Effective 3/25/2017 Superseded 5/14/2019 59-7-106 Subtractions from unadjusted income. (1) In computing adjusted income, the fol

OPTOTAX - #optotaxitupdates #Extension of #DueDates under #IncomeTax ✓ Filing of Belated Return under Section 139(4) for AY 2020-21 has been Extended to 31st May, 2021 ✓ Return filed in response to

Taxpayers filing returns with Section 199A deductions—more likely to incur accuracy-related penalties under Section